Maintaining Happiness and Perspective Despite “Downward Revisions”

In finance, a “downward revision” is often a fancy way for corporations or governments to say things aren’t turning out as well as we thought they would. We have seen a lot of this since the global emergence of Covid – 19, and that may be far from over. This has been affecting both our personal lives and our wallets. The question is… what can we do about it?

Let’s start by defining the problem in greater detail

Before we get to the financial issues, let’s take a look at some of the downward revisions that have been happening in our personal lives. Remember when we thought children may return to school before the end of the school year? Downward revision. We thought Major League Baseball would be playing games by July 1. Downward revision. The pro baseball season start date is now penciled in as July 23 or 24th. And with some major league baseball and college football practice facilities, we could certainly have future downward revisions looming.

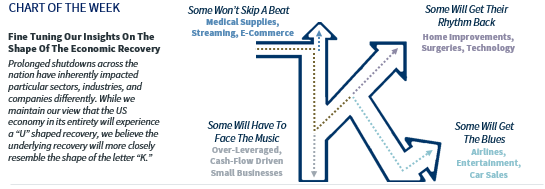

As far as the markets go, analysts started by saying we should expect a “V” shaped recovery. Looking at a graph, this would be a steep drop followed by a bounce off the bottom before we relatively quickly returned to normal. Then, the “V” became a “U”. Go down… stay down for a while… bounce back. Now, Raymond James CIO Larry Adam astutely says the recovery will look like a “K.” This is a promising outlook for some businesses and very bad news for others depending on where you fall on the “K.”

The material was prepared by Raymond James Investment Strategy. https://www.raymondjames.com/-/media/rj/advisor-sites/sites/s/t/stackhousewealth/files/weekly-headings_4-24-20.pdf

While we are told a vaccine is promising, it is not guaranteed. RNA vaccines can be difficult as these types of viruses often mutate. The market will continue to fluctuate as it seeks to price in the news it receives… both good and bad.

The Simple Solution

To quote an article by Dr. John Johnson in Psychology Today, he references an old saying that goes, “Expectations are premeditated resentments.” So we are given the choice of having no expectations (which is boring), or getting better at being disappointed. I would choose the second option. Now is the time to get better at being disappointed

As this applies to your investments, disappointment often has to do with measuring your investment results over the wrong time periods. It’s critical to have your investments allocated in such a way the money you need to spend of the near-term is not invested in vehicles prone to short-term disappointment.

In our personal lives, getting better at disappointment means being ready at any time for something good to happen but not always reaching for it. This pandemic has helped remind many of us of the beauty of some very simple positive areas of our lives.

I wish you all the best as we move through this, and I hope that any disappointments you may find along the way will remind you of the many good things in your life.

-Jay Wheeler

All expressions of opinion reflect the judgment of the author (or the Investment Strategy Committee when indicated) and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results.